In a U.S. EV market wrestling with rising competition, fading incentives, and softening demand, Tesla is making a bold move: rolling out a new “affordable” Model Y variant. For U.S. buyers, this could shift the playing field. After the $7,500 federal EV tax credit expired at the end of September, EV pricing got tougher — and a lower-cost Tesla might bring renewed momentum.

It’s not just about price. The affordability push hints at Tesla strategically reacting to rivals from China and Europe making aggressive EVs for less. A stripped-down Model Y could attract mainstream buyers who’ve long eyed Tesla but stayed away for cost reasons. In short: this isn’t just a variant — it might be Tesla rethinking its U.S. market approach.

What’s Leaked & Confirmed About the New Model Y

Teasers, Sightings & Pricing Hints

Recent reports say Tesla is set to unveil a budget Model Y variant on October 7, 2025. Teaser videos dropped by Tesla show slim headlights, a spinning wheel, and cryptic dates — signs the reveal is impending. Car and Meanwhile, spy shots have caught a prototype missing the LED light bar and other premium features, suggesting aesthetic simplifications.

If reports hold, the price could dip under $30,000 (once eligible for credits), making it significantly cheaper than current Model Y trims. Tesla insiders also suggest internal cost reductions — like fewer premium features, simplified materials, and possible single-motor layout.

Company Direction & Internal Strategy

Elon Musk has already confirmed the new entry-level Tesla will be a scaled-down Model Y, not a completely new vehicle. Production target is mid-to-late 2025, with internal code name references to “E41” tied to cost-cut Model Y development. Earlier, Tesla also laid groundwork by planning a lower-cost Model Y version to defend its China share, implying global strategy consistency.

Also take a look at this topic: Moto Morini’s Calibro 700 Bagger Is America’s Next Affordable Touring Star

Speculations (and What Might Be Cut)

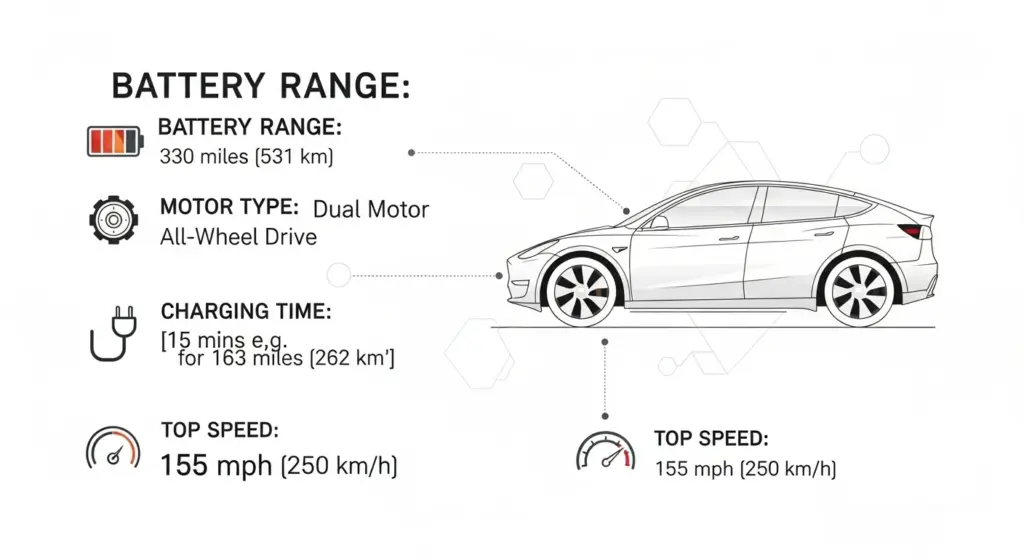

Here’s a projected spec sheet for the new low-cost Model Y, based on leaks and analyst guesses:

| Component | Projected / Leaked Range | Likely Change / Impact |

|---|---|---|

| Drive Motor | Single rear motor (RWD) | Cuts cost vs dual-motor AWD |

| Battery | Smaller pack (vs current) | Maintains range but lowers capacity |

| Power Output | ~230–270 hp (est.) | Enough for daily use & highway merges |

| Range | ~260–300 miles (EPA est.) | Slight drop vs premium variants |

| Top Speed / 0–60 | ~120–130 mph / ~5.5–6.0 s | Moderate for mainstream usage |

| Interior Features | Simpler upholstery, fewer comforts | Cost control, less premium feel |

| Visual Elements | No light bar, simpler bumpers | Distinct “budget” styling cues |

| Infotainment / Tech | Retained central screen, minimal extras | Core Tesla features retained |

Real-World Impact:

Expect trade-offs for price. Some luxury appointments may vanish — cloth seats instead of premium materials, fewer speakers, simpler suspension tuning. But key Tesla DNA (touchscreen, navigation, autopilot systems) may survive in pared-down form. It would still handle highway runs, daily commutes, and occasional longer trips, albeit with slightly less margin for “fun mode.”

How It Lines Up Against Tesla & Rivals

Versus Existing Model Y Variants

The new Model Y would slot below current Long Range and Performance trims — competing on accessibility. The existing 2025 refresh (“Juniper”) already updated light bars, drag optimization, and interior tweaks. The budget variant may borrow that design language but strip decorative elements and reduce feature count.

Versus Competing EVs

Key rivals include Chevrolet Bolt EV / EUV, Chevy Equinox EV, Ford Mustang Mach-E base, and Chinese EVs gaining U.S. foothold (BYD, Xpeng, etc.). To win, Tesla must balance cost cuts with maintaining brand perception and charging network advantages (Supercharger access). A sub-$30k Tesla would stand out — but only if experience feels credible.

Also take a look at this topic: 2025 Suzuki Hayabusa Gets Smarter: New Tech & Colors Drop

Risks, Challenges & What U.S. Buyers Should Watch

- Margin squeeze & quality risk: Aggressively lowered cost means less headroom for errors. Poor build or interior feel will be scrutinized.

- Feature cannibalization: If the low-cost Model Y is too tempting, it might eat into more profitable trims. Tesla needs clear segmentation.

- Supply chain & component scarcity: Batteries, semiconductor costs, and materials remain volatile — reducing features is easier said than executed.

- Regional model allocation: U.S. demand might far exceed supply; buyers may face long waitlists, making perception critical.

- Regulatory / safety compromises: Any perceived shortcuts in safety equipment could invite backlash or regulatory scrutiny.

Signals to monitor: official Tesla unveil or livestream, pricing documents, vehicle registrations, early user impressions, build quality leaks.